The Invisible Shift Already Underway

AI agents are quietly taking over our everyday tasks. What started as simple automation—voice assistants reordering groceries, smart reminders for bill payments—is evolving into something fundamentally different. Experts predict that the traditional SaaS interfaces we rely on today will gradually give way to intelligent agents that don’t just assist us, but act on our behalf.

Early use cases are already live across industries, with many more in development. As shopping, travel and daily experiences become increasingly autonomous, one critical question emerges: How do payments fit into this new world?

For these experiences to remain seamless, payments must also become autonomous—operating securely, contextually, and invisibly in the background. This is where Agentic Payments come in, connecting intent with transaction in the age of intelligent automation.

A Decade of Quiet Revolutions

At Rootware, we’ve spent over a decade watching payments reinvent themselves, always quietly. Online checkout replaced the queue. Mobile wallets replaced the card swipe. Now, another shift is unfolding—subtle yet transformative.

This change isn’t just digital; it’s behavioural. We’re no longer the ones clicking “Pay.” The systems we built are starting to think for us, moving from reactive to proactive, and now from assistance to genuine agency.

This marks a pivotal moment: payments will stop waiting for human input and start working through trusted, verified agents.

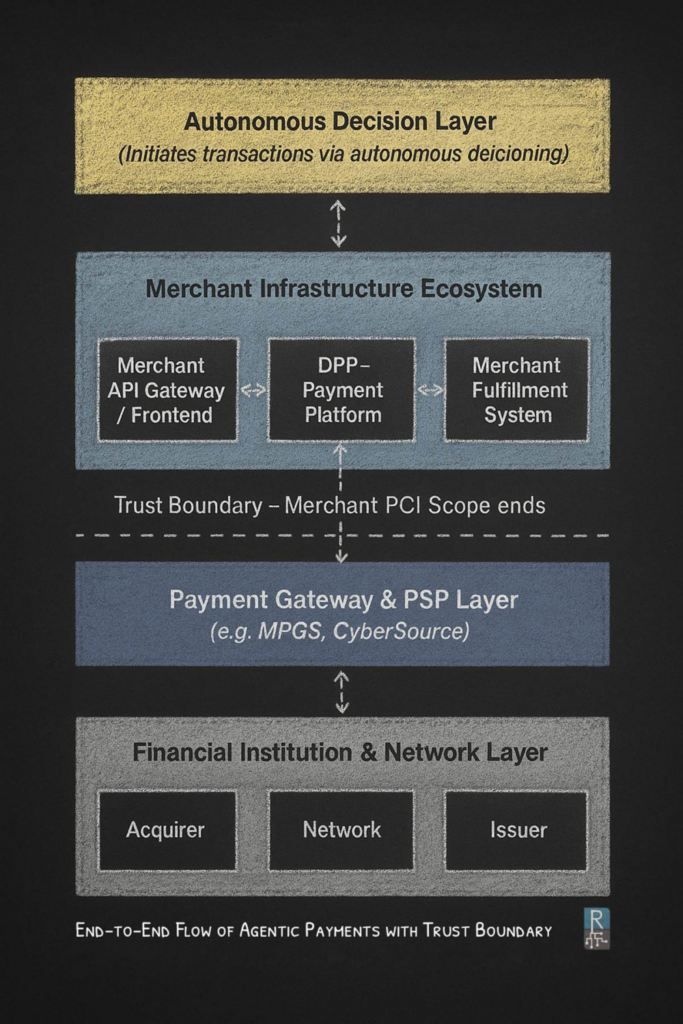

For merchants, payment orchestration platforms like our Digital Payment Platform (DPP) already manage end-to-end flows from checkout to settlement. As Agentic Payments evolve, platforms like DPP, will play a central role in enabling and validating intelligent payment interactions.

From Automation to Agency: A Simple Story

Let’s make this concrete with a familiar scenario.

You’re planning a five-day trip to Dubai. Traditionally, that means opening multiple tabs, comparing flights and hotels, entering card details repeatedly, and confirming OTPs at every step. It’s routine, yet exhausting.

Now imagine this instead:

You tell your AI assistant: “Plan a five-day trip to Dubai next month within a $1,000 budget. Prefer beach hotels and morning flights.”

That’s it. No searching, no browsing, no checkouts.

Your AI—let’s call it TravelAI—gets to work: scanning flights, shortlisting hotels, booking transport, and selecting activities that match your preferences. It doesn’t just follow rules; it makes judgments, balancing cost, comfort, and timing better than you might on a busy workday.

When the plan looks right, it pays on your behalf. No OTPs, no forms, no wallet apps. Just a trusted digital actor completing the transaction using your credentials and consent, but with its own verified identity.

This isn’t science fiction. It’s what Agentic Payments are designed to enable, bridging intent and transaction and to act safely, within the boundaries “we define”.

The Critical Difference: Automation vs. Agency

Here’s the distinction that matters:

-

- Automation follows fixed rules: “Recharge when balance drops below $10.”

- Agency weighs context and decides: “You’re traveling tomorrow. Should I activate roaming?”

And if you’ve given permission, agency doesn’t just suggest—it acts.

That’s the real shift. Systems that once waited for instructions are now beginning to understand our intent. Once they can interpret purpose, how we pay—and how we think about payments—changes completely.

How Agentic Payments Work: The Foundation

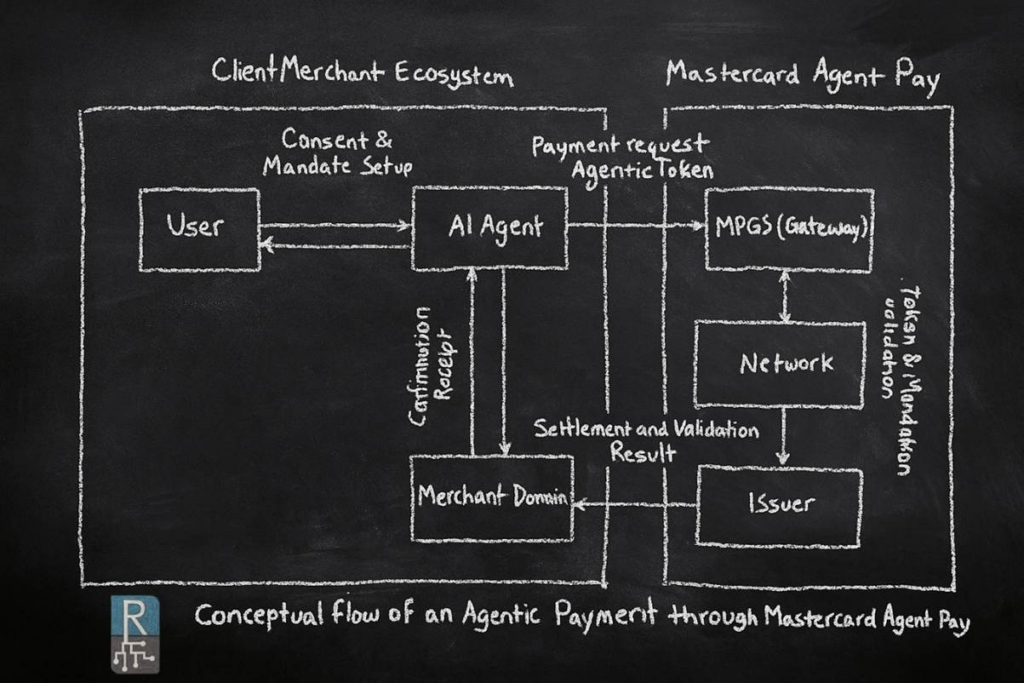

The first concrete implementation is taking shape through Agent Pay, introduced by Mastercard on its Payment Gateway Services (MPGS) platform. In this model, AI agents are registered and verified within Mastercard’s trust framework, defining how they can be recognized and authorized to transact securely.

The Core Components

1. Agent Registration AI agents are registered in a trusted registry and assigned unique identifiers, similar to how merchants are verified today.

2. Mandate Framework Users define clear boundaries: spending limits, merchant categories, time validity. Think of it as giving your agent a mission brief with guardrails.

3. Agentic Token A cryptographic token links the authorized agent with tokenized payment credentials and the scope of your mandate. Tokens can be rotated or revoked instantly if circumstances change.

4. Verification and Traceability Every action is validated by the network, logged for auditability, and traceable to a verified agent identity. Trust without transparency isn’t trust—it’s blind faith.

Together, these components introduce a new layer of intelligence to payments: systems that can act on our behalf, always within clear, auditable boundaries of consent.

What This Means for Merchants

Ecosystem readiness will matter more than reinvention.

Phase 1: Agent-Aware Merchants

In the initial phase, merchants become agent-aware—able to recognize and accept transactions initiated by trusted AI agents. Gateways like MPGS manage verification and trust exchange in the background. From the merchant’s perspective, the checkout remains familiar; only the initiating actor changes.

Phase 2: Agentic Merchants

Over time, larger enterprises may evolve into agentic merchants, deploying AI systems capable of interacting directly with customer agents. Imagine an airline’s AI negotiating fares with your travel assistant, finalizing the itinerary, and completing the booking autonomously. Commerce becomes conversational—not between buyer and seller, but between their digital representatives.

What Readiness Really Means

For platforms like our DPP, readiness isn’t about building new rails. It’s about:

-

- Recognizing this new participant in the payment flow

- Adapting orchestration layers to carry trust metadata

- Capturing agent context in settlement files and reconciliation reports

- Surfacing agent information during chargebacks and disputes when required

Authorization, settlement, reconciliation, and dispute processes must all carry the same trust context end-to-end.

Rootware’s Role in This Transformation

At Rootware, we’re already working with leading payment gateways to bring agentic payment capabilities into our Digital Payment Platform (DPP). This will allow merchants to seamlessly integrate with agent-driven payment flows, while maintaining the same orchestration, compliance, and trust frameworks they rely on today. It’s an early step toward enabling merchants for a new generation of intelligent, autonomous commerce.

The Ecosystem is Aligning

A consistent pattern is emerging across the payments landscape:

-

- Payment networks like Mastercard and Visa are extending their trust frameworks for agent-initiated transactions

- Technology players like Google are defining how agents exchange consent and discovery signals

- Banks and PSPs are testing context-aware payments that adapt to user intent

These developments point toward an intelligent commerce layer where AI-driven decisions and secure, regulated payments coexist on the same trusted infrastructure.

The Future: Trusting Intent

For decades, payments have revolved around a single moment—the checkout—where intent becomes action. Agentic Payments are designed to make that moment almost invisible.

Commerce is moving from clicks to conversations, from interfaces to intent. Payments will no longer interrupt the experience; they’ll complete it quietly through trusted agent-to-agent interactions.

The New Landscape

-

- Merchants will increasingly compete for AI-agent recommendations alongside user attention

- Payment networks will expand their role beyond cards and devices to manage trust between digital actors

- Platforms like DPP will evolve into the trust fabric connecting both sides

The future of payments won’t just be about faster checkouts or smarter wallets. It will be about trusting intent—where every transaction reflects confidence that a verified agent has acted securely and responsibly on behalf of the person it represents.

A Gradual Revolution

Agentic Payments will emerge gradually through pilots and early adoption: one verified agent, one trusted mandate, one autonomous transaction at a time. Success will depend on how well agent signals integrate with existing flows without creating new failure points.

When that alignment happens, we’ll realize that the real revolution isn’t in the technology itself—it’s in how trust moves through the payment ecosystem.

Beyond Payments: The Broader Transformation

Agentic payments are just one part of a broader transformation shaping the future of commerce. As merchants adapt, the ecosystem around them must evolve as well, covering areas like fraud detection, chargebacks, liability shifts, dispute handling, and new trust models between agents and payment networks. These are complex but exciting topics that we’ll explore in future articles to share a more complete view of where digital payments are headed.

The question for all of us: Would you trust an AI agent to decide when and how to pay on your behalf?

Researched and authored by – Gowtham Ankireddy (Director IT)